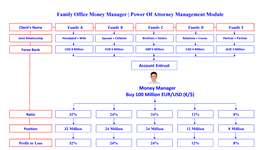

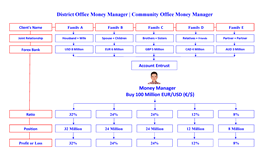

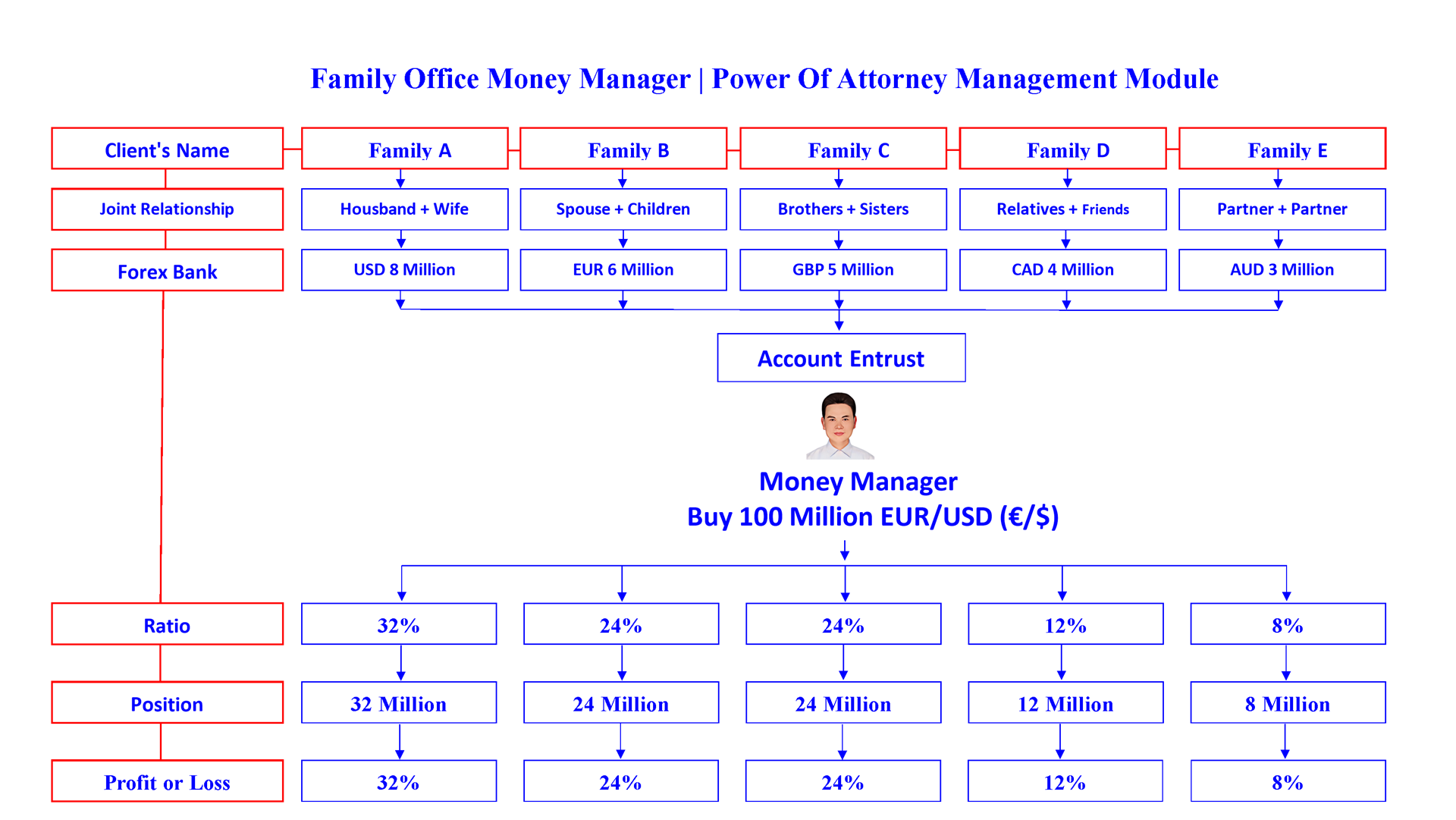

A few words introduce self-management of family funds with MAM · PAMM

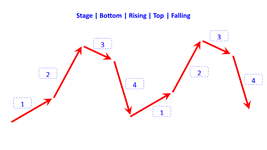

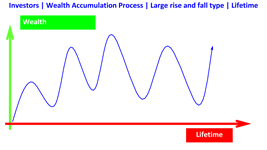

In order to reduce the risk, you have to diversify your investment. In order to diversify the investment, it is necessary to deposit funds in different banks.

Even if the funds are placed in the same bank, in order to avoid the risk of taxation of excessive funds, the funds of the same bank have to be divided into multiple joint accounts.

Why open a joint account? You can use the joint account to dilute the total amount of funds, and more importantly, avoid the risk of hidden losses of funds.

Why?

People will have time to leave the world, especially life is impermanent, no one can avoid accidents. Even if there is an accident, one of the joint account holders still controls the transfer authority safely.

If it is a single account, the heir may not know that there is such a fund. Even knowing that cumbersome inheritance procedures and passive situations may allow the heirs to spend a lot of time, energy, and even financial resources to finally get this legacy. The joint account avoids this risk and trouble.

Even if the family's bank account, the same bank, and several accounts at the same time, it will bring inconvenience to the investment operation.

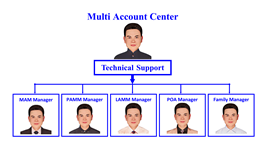

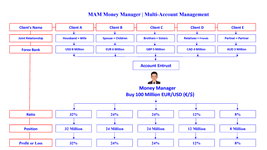

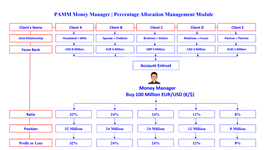

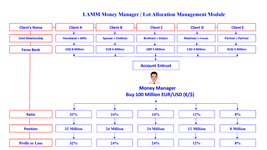

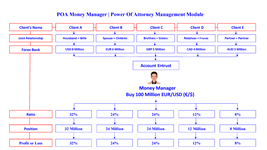

PAMM technology effectively solves this problem. Multiple family accounts can be invested and traded by a single management account one-click operation, making everything relatively simple and uncomplicated.

My office is near CHINA IMPORT AND EXPORT FAIR | Visit Office

Office is 2 stops away from CHINA IMPORT AND EXPORT FAIR

Office is 3km away from CHINA IMPORT AND EXPORT FAIR

Visit appointment 2 weeks in advance!

Scan Whatsapp contact me

Scan Wechat contact me